Momenta's Take #35

ESG: New North Star for Investing

Michael Dolbec

Companies with a good ESG story to tell will fare better in Raising Capital

There’s growing awareness of the importance ESG (environmental, social, and governance) factors when it comes to corporate mission and strategy, and importantly from leading investors.

Because of growing demand for funds with ESG strategies, there is increasing interest in companies that can exhibit good ESG characteristics or for companies that can articulate a good story of transition and transformation (for instance, in industries such as Oil and Gas that may not rate highly on environmental factors).

A quick refresher on the relevant components of ESG from McKinsey:

The environmental component might focus on a company’s impact on the environment—for example, its energy use or pollution output. It also might focus on the risks and opportunities associated with the impacts of climate change on the company, its business, and its industry.

The social component might focus on the company’s relationship with people and society—for example, issues that impact diversity and inclusion, human rights, specific faith-based issues, the health and safety of employees, customers, and consumers locally and/or globally, or whether the company invests in its community, as well as how such issues are addressed by other companies in a supply chain.

The governance component might focus on issues such as how the company is run—for example, transparency and reporting, ethics, compliance, shareholder rights, and the composition and role of the board of directors.

What’s Driving Growth in Responsible Investing?

The critical factor behind the growth of ESG funds in the generational wealth transfer as Boomers retire and downsize. Looking forward, Millennials are increasingly going to be making decisions of where to invest for their own retirement, children’s college funds, and other goals. Research has repeatedly shown that Millennials prioritize doing good in the world over pure returns.

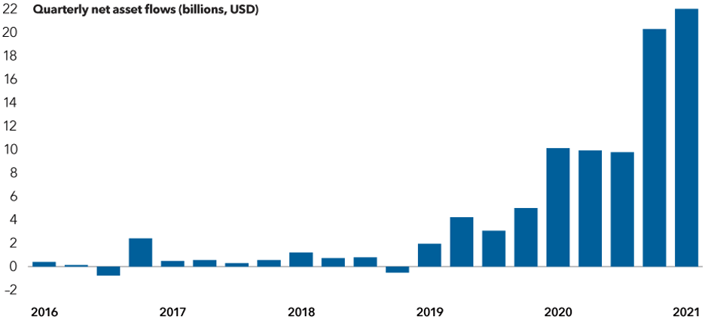

We’ve written previously about the significant increase in Assets Under Management (AUM) being allocated to ESG funds, and in 2020 there was $51.1 billion channeled into sustainable funds.

ESG funds are attracting record-breaking inflows

Global ESG ETFs have seen impressive inflows of funds, with assets under management (AUM) increasing from $6 billion in 2015 to $150 billion in 2020.

Sources: Capital Group, Morningstar. As of 3/31/21. Includes U.S. mutual funds and ETFs but excludes fund of funds.

While this is notable from a business perspective, this also means that these institutional funds are going to be looking for and evaluating investments with a high priority on ESG components. The increase in AUM means that the key factor driving asset managers’ focus on ESG is the desire to grow their own businesses.

Measuring and valuing ESG factors remains more of an art than a science, as major investment fund managers have been focusing on the methodologies and research needed to make better-informed decisions and how to support ESG strategies. Much of the momentum in the investment community is coming out of Europe, with new disclosure regulations compelling fund managers across the globe to focus on ESG components in their analysis.

Beyond Pure Returns to ESG Inclusiveness

Many seasoned investors started with tracking pure green investments, but historically the return had been less than stellar (particularly solar investments in the late 2000s). While the goal for investment managers is the best return, the role of ESG is gaining more importance in the process as major fund managers adopt ESG principles into their mission, and of course, as more funds go into ESG funds. Increasingly, we are seeing ESG principles adopted by Private Equity investors, and there is growing evidence that doing good is also good business.

Investors Driving Corporate Focus on ESG

The investment community is becoming a pivotal catalyst to encourage companies to focus on their own ESG strategies. It’s not just equities (stocks); there is a lot of momentum from the fixed income sector as well. From a credit perspective, companies with favorable ESG scores tend to have lower credit risk, systemic risk, and overall governance risk.

There is a process called engagement where investors look at their existing assets and evaluate their ESG profile. If a particular company falls short on key measures, the investor can either sell the assets, stay with them (and lower the ESG score for the portfolio), or work directly with companies to help them improve their ESG scores. Investors are doing more by encouraging companies in “brown” industries to move in a more sustainable direction.

Demand for ESG Investments Outstrips Supply – For Now

There is an imbalance of companies and investments with good ESG characteristics and the demand from investors, and for now, this works to the benefit of companies that “check the box.” In industries like tech and internet, which are already green investment friendly, frothy valuations reflect crowded holdings, making it more difficult for funds to deliver outperformance.

Investors will be looking for new opportunities, such as in “dirty” industries, to make the case that they are focusing on sustainable ESG factors, such as metallurgical coal miners that produce the materials needed for clean energy and technology uses or steelmakers that help produce wind turbines. Companies with a good ESG story to tell will fare better in raising capital.

Coming Up – We Explore ESG Impact on Industry

We will be looking at how this influx of investments in ESG funds is driving the growing corporate focus on ESG in industries like Energy, Manufacturing, Smart Spaces, and Transportation – and how this is playing out on the ground today and into the future.

Momenta encompasses leading Strategic Advisory, Talent, and Ventures practices with over 250 IoT leadership placements, 150 industry clients, and 50+ young IoT disruptors in our portfolio. Schedule a free consultation to learn more about our Digital Industry practice and services.