Dec 1, 2020

| 6 min read

Momenta's Take #18

In mid-November one of the most long-awaited IPO filings came from C3.ai, the company founded by its CEO, Silicon Valley legend Tom Siebel in 2009. Siebel got his start in the mid-1980s with Oracle and was instrumental leading growth of the relational database market. In 1993 he founded Siebel Systems which pioneered CRM (Customer Relationship Management) software, moving early into analytics before selling the company to Oracle in 2006 for $5.8 billion.

C3.ai is looking to become the dominant vendor selling AI and Machine Learning-powered software platform-based applications to industrial companies, bridging the historical divide between Operational Technology and Information Technology with a cloud-based SaaS approach. So far the company’s scale, growth rate, marquee customers and partnerships with the likes of Microsoft and Adobe position it as a formidable enterprise software players.

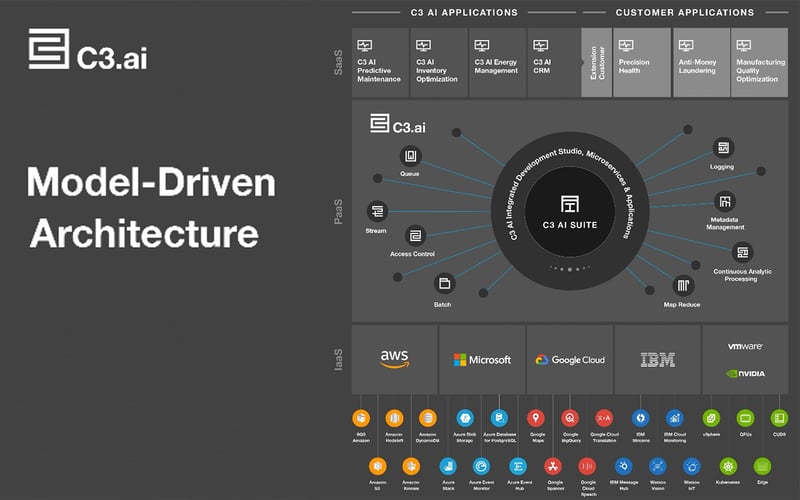

The company has two major offerings:

The company’s focus on a model-driven approach hearkens back to the approach pioneered for CRM by Siebel System in the early 2000s, but updated with a cloud-based, modern architecture.

C3.ai is focused on building enterprise-scale AI applications and accelerating digital transformation. Since its founding the company has evolved its focus - from energy management and analytics initially, to IoT to Artificial Intelligence applications. According to CB Insights, C3.ai has raised $356M in rounds of fundraising, with several large rounds led by TPG Capital. Other investors include Baker Hughes, BlackRock, FS Investors, Breyer Capital, Sutter Hill, Interwest and Makena Capital. C3.ai is clearly positioning itself as one of the few focused enterprise AI companies to go public: the ticker symbol on the NYSE will be “AI”.

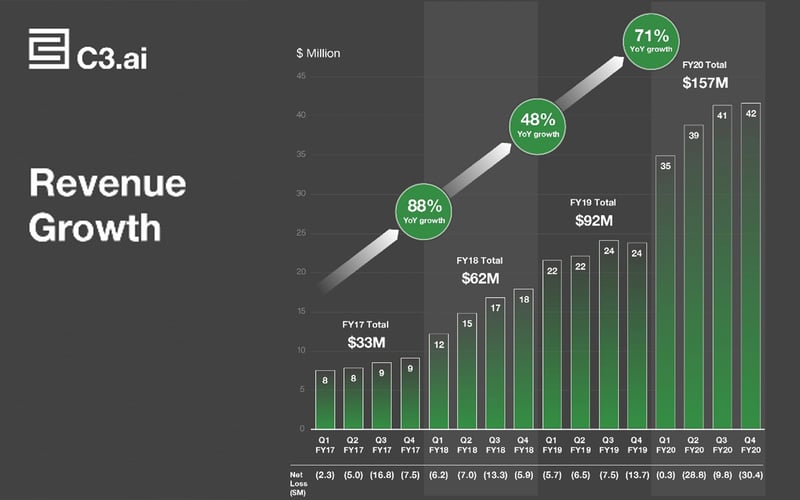

According to its S-1 filed with the SEC, C3.ai reported $157 million in revenue, reflecting 71% YoY growth for Fiscal Year 2020. The company reported a 75% gross margin and $69 million net loss for the year, a reasonable trajectory for a high growth company. Software subscriptions accounted for nearly 90% of revenue. C3.ai says it generates 1.1 billion predictions per day on behalf of its customers, with 4.8 million machine learning models in production, powered by data coming from 622 million sensors.

The company does not disclose the number of customers, but deal sizes are large - according to the S-1, average deal size over the past five years increased from $1.2 million to $11.7 million, $10.8 million, $16.2 million, then $12.1 million. There is also a fair degree of customer concentration - the top two customers accounted for 36% of revenues in FY20, with the top four customers accounting for 69% of accounts receivable as of July 31, 2020.

The dual class structure ensures that founder and CEO Siebel will maintain control of the company. For the IPO, C3’s stock will be split into Class A stock (with 1 vote each), and Class B stock (with 50 votes each) which is almost completely controlled by Thomas Siebel.

According to the S-1 filing, Siebel holds 75.8% of the combined voting power from his ownership of 97.9% of the Class B shares, and 33.9% of Class A shares. TPG owns the largest investor stake at 22.6%, with partner Baker Hughes holding 15.1%. The strategic partnership with oil and gas services company Baker Hughes is a substantial portion of revenues representing 25% of total sales in FY20, with nearly $53 million expected from fees and resales in FY21.

The company is making the case that the market opportunity is far greater than Siebel’s previous companies: according to his shareholder letter: “Today, at the confluence of these technology vectors we find the phenomenon of Enterprise AI and Digital Transformation, mandates that are rising to the top of every CEO’s agenda. The global IT market exceeds $2.3 trillion today.” The size of the market C3.ai addresses is roughly $174 billion this year, expected to grow to $271 billion by 2024.

Given that the industry is still in early stages of AI-powered enterprise digital transformation, C3.ai is positioning itself as a pioneer in this category. Based on the quality of customers, partners and relative maturity of the business compared to competition, there is likely to be significant investor interest given the thematic attractiveness of AI, as well as the increasing sign of economic recovery post pandemic.

Momenta delivers digital transformational innovation, growth and leadership across energy, manufacturing, smart spaces and supply chain. As deep Digital Industry Practitioners, we help companies grow through one-stop advisory, M&A, executive search and venture capital services. Feel free to schedule a call to explore your company's Digital potential.